However, the difference between them is that designated funds are set aside for a specific end by the nonprofit itself, while restricted funds are restricted by the donor. It involves updating donors on the use of their funds, seeking their input if changes are needed, and ensuring their ongoing engagement and support for the organization. By understanding and managing restricted assets, nonprofits can not only adhere to legal and ethical standards but also strengthen their relationships with donors, ensuring ongoing support for their missions.

Easily Manage Your Donor & Fundraising Needs in Bloomerang!

- By adhering to these practices, nonprofits demonstrate their dedication to compliance and stewardship of the funds entrusted to them by donors and grantors.

- If necessary, organizations should seek legal clarification or permission from the donor to repurpose funds.

- Regular financial reviews help organizations stay on track and make necessary adjustments.

- When they donate to a specific cause or purpose, they want to be able to see that the nonprofit has followed the instructions properly.

When donors, grantmakers, and other funders contribute to your organization, they have the right to add restrictions to their gifts. These restrictions provide the funders with a level of control over how your nonprofit spends the funds they contribute. They can therefore ensure their money is used to support the aspect of your cause that matters most to them. The first difference is that nonprofits must reinvest all of their funds back into the organization itself, rather than focusing on how to make the greatest profit.

Handling Unrestricted Funds

Many nonprofits that offer scholarships will invest scholarship funds for future use. Nonprofits may also invest restricted funds that they can’t use for their nonprofit’s operations. Only the income generated from investing these funds can be used, typically for purposes specified by the donor. For example, a donor might establish an endowment to support ongoing research in a particular field.

Package B Includes:

Additionally, many states have their own reporting requirements, which may include annual reports or specific disclosures related to restricted funds. Non-profit organizations must navigate complex accounting practices to ensure compliance and transparency, especially in the differentiation and management of restricted and unrestricted funds. These FAQs address the most pertinent aspects of accounting for these funds within the framework of financial reporting and regulation.

By doing so, nonprofits can demonstrate how restricted funds are being utilized in specific areas, thereby providing a more granular view of their financial activities. This level of detail is particularly useful for donors who want to see the direct impact of their contributions. Nonprofits must legally adhere to donor stipulations when restricted funds on balance sheet managing restricted funds. Trust law principles enforce this obligation, requiring organizations to steward the funds for designated purposes only. Failure to comply can lead to legal actions, and regulatory bodies such as the IRS closely monitor the use of these funds to ensure compliance with tax laws and charitable giving regulations.

Fund accounting is a unique system designed for nonprofit organizations to ensure that they honor donor restrictions and manage their resources responsibly. In practice, a nonprofit’s financial statements must clearly present both restricted and unrestricted funds. This is often achieved by maintaining separate accounts for each category within the organization’s chart of accounts. By segregating funds, nonprofits can provide accurate reporting to donors, management, and regulators. In this example, FAN has recorded the three-year, $60,000 grant in the first year, as required.

Typically, fund designation is specified in writing in what is termed the gift instrument. Foundations that provide restricted funds often describe how they want their money allocated when they distribute the award. A donor of restricted funds to a nonprofit usually designates what the money can be used for in a written document called the gift instrument.

If you’re a very small nonprofit, it’s possible you won’t have any restrictions on your donations. But once you start getting larger donations or grants, fund accounting quickly becomes a necessity. And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. Instead, the separation should be dealt with by accounting practices on the nonprofit’s financial statement. Nonprofit employees should be trained to identify expenditures that require allocation to restricted funds. When the staff correctly allocates money, it keeps donors satisfied and helps avoid legal disputes.

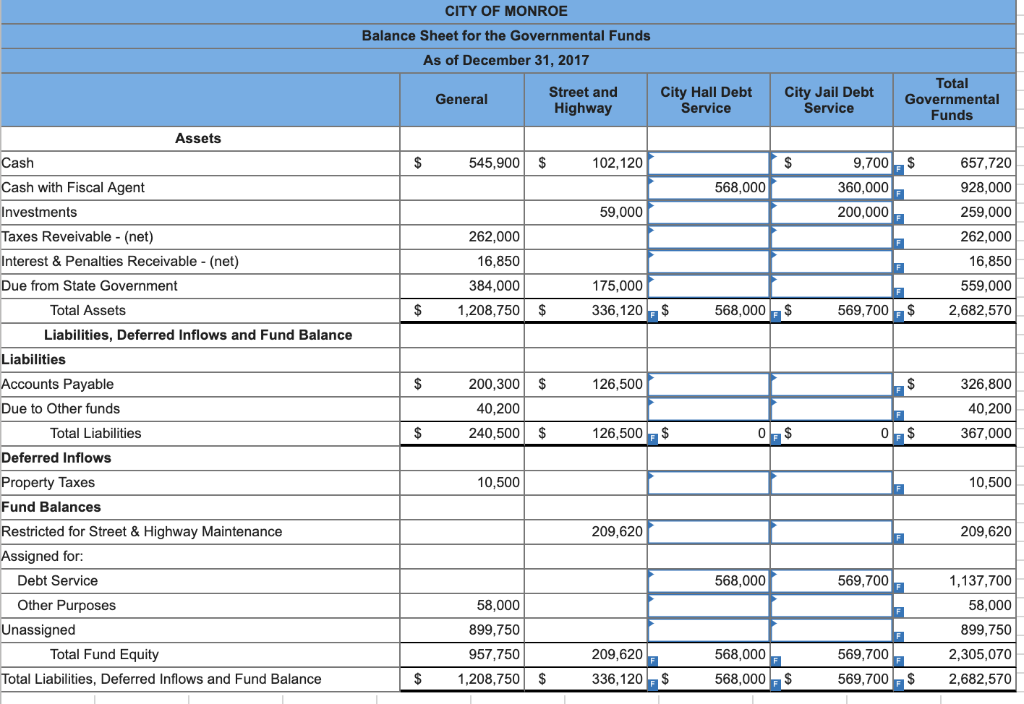

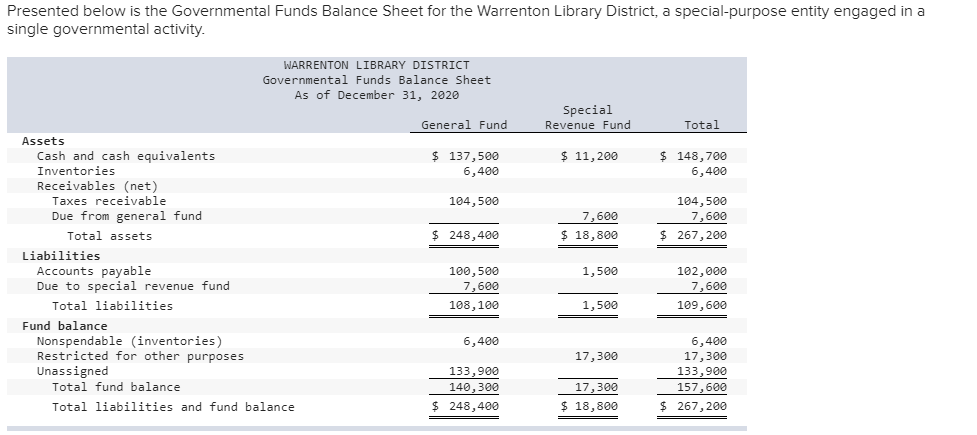

The funds are restricted by law, so if they are not used for the designated purpose, a donor can initiate legal action and demand their return. Nonprofit organizations can avoid confusion about how they intend to spend a donor’s funds by offering a choice of designation. A cancer research nonprofit, for example, could give donors a choice to allocate their funds to any one of breast, skin, or brain cancer clinical trials. GASB Statement no. 54, Fund Balance Reporting and Governmental Fund Type Definitions, will significantly change how this information is reported. The statement is intended to improve the usefulness of the amount reported in fund balance by providing more structured classification. The statement also clarifies the definition of existing governmental fund types.

Fund balance is an important measure that represents the difference between a fund’s assets and liabilities. The overall objective of fund balance reporting is to isolate that portion of fund balance that is unavailable to support the following period’s budget. Re-allocation of restricted funds is generally not permitted unless the donor gives explicit permission.

That makes it easy for you to run fund-level reports to share with your benefactors. Each restricted fund is typically treated separately, almost like an independent business. Budgeting will be separate, so will expensing, and other aspects of the accounting process. Organizations should ensure that their stewardship strategies encompass both honesty in reporting and fidelity to donor’s specifications, strengthening their integrity and accountability to their donor base.

Reporter Name

Reporter Name