One of the main risks is new listing token the potential for accumulating open positions if the market moves strongly in one direction. It’s important to carefully manage position sizing and monitor market conditions to mitigate these risks. In grid trading, a trader sets up a grid of buy and sell orders above and below the current market price. As the price fluctuates, these orders are executed, creating a series of trades.

- In grid trading, you create a grid of buy and sell orders at predetermined price levels.

- In scenarios where the prices of cryptocurrencies like Bitcoin experience a sharp increase, grid bots might realize profits sooner.

- Yes, the Grid Trading Strategy can be automated using trading bots or expert advisors, streamlining the execution process.

- The trader would unfortunately then be sitting on losses that could potentially increase if the market continues falling.

- Asktraders is a free website that is supported by our advertising partners.

- Yes, grid trading is legal in many countries, particularly in Contract for Difference (CFD) trading.

Crypto.com may not offer certain products, features and/or services on the Crypto.com App in certain jurisdictions due to potential or actual regulatory restrictions. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Observe the grid as a whole instead of paying attention to each individual trade inside the grid. Set profitability targets for your grid, such as 5% or 10%, and close your trade once you’ve hit them.

What is Grid Trading Strategy?

The beauty of this technique is that you can easily automate it in the same way that you automate a stop loss. Users can set many, or just a few, price levels in the grid, depending on their personal preferences and circumstances. Grid trading can also be combined with other trading strategies; technical analysis is one of the most common.

During strong trending markets, grid trading can result in increased market exposure and potential losses. As prices move in one direction, traders may experience consecutive losses on one side of the grid. Automation of the grid trading strategy can be achieved through the use of Grid Bots. These bots operate 24/7, capturing trading opportunities even when the trader is not actively monitoring the markets. They execute the grid strategy with discipline and consistency, devoid of emotional biases. Take into account that regardless of the option used to utilize the grid trading strategy, you must backtest your strategy on a demo account before deploying it on a real account.

In markets exhibiting create your own swatch wallets strong trends, grid trading can increase exposure to losses. This occurs as the strategy might struggle to adapt quickly to a market that consistently moves in one direction, leading to consecutive losses on one side of the grid. In sum, each of the strategies above has its unique applications and benefits, and choosing the right one depends on the trader’s market understanding, risk appetite, and trading objectives. Adapting to the market’s character and volatility can significantly enhance the effectiveness of the grid trading approach in Forex trading.

What is the ideal grid interval for different markets?

Markets are fickle and may not move in the way the grid was initially set up to work best in. Deploying a systematic strategy like grid trading helps to avoid these cognitive biases by enabling the trader to avoid their worst enemy — themselves. Traders should establish clear rules for setting stop-loss and take-profit levels, and for managing the overall risk of their portfolio. Traders should set stop-loss and take-profit levels for each trade, and they should have a plan for managing the overall risk of their portfolio. The trading bot could trigger multiple buy orders at low price ranges, how to buy akita inu causing a trader’s position to grow. If the price continues moving in their direction, they are more likely to profit.

A more intricate and risk-laden type of grid trading, futures grid trading involves the use of margin trading. This approach allows traders to engage in larger trades than their existing capital would ordinarily permit. While futures grid trading can potentially lead to higher profits, especially in volatile crypto markets, it also substantially increases the risk factor.

Grid Trading Limitations

Traders should regularly evaluate the performance of their grid trading strategy. This includes monitoring key performance metrics like the profitability ratio, win-loss ratio, maximum drawdown, and risk-adjusted return. Cryptocurrency grid trading involves trading digital currencies within a grid. With the high volatility in cryptocurrency markets, this strategy can be profitable. However, it also comes with increased risk due to the highly speculative nature of these markets.

As the price fluctuates within the defined range, the strategy triggers buy and sell orders at regular intervals. Profits are made when the price moves back and forth between these orders, and the pre-set stop loss levels limit losses. This crucial parameter determines the highest price at which you plan to sell your crypto assets.

Once the price hits the limits specified in the grid settings, a buy or sell order is triggered automatically. A hedge grid trading strategy places both long- and short-sell orders inside the same grid. This enables the strategy to potentially profit no matter whether the price rises or falls.

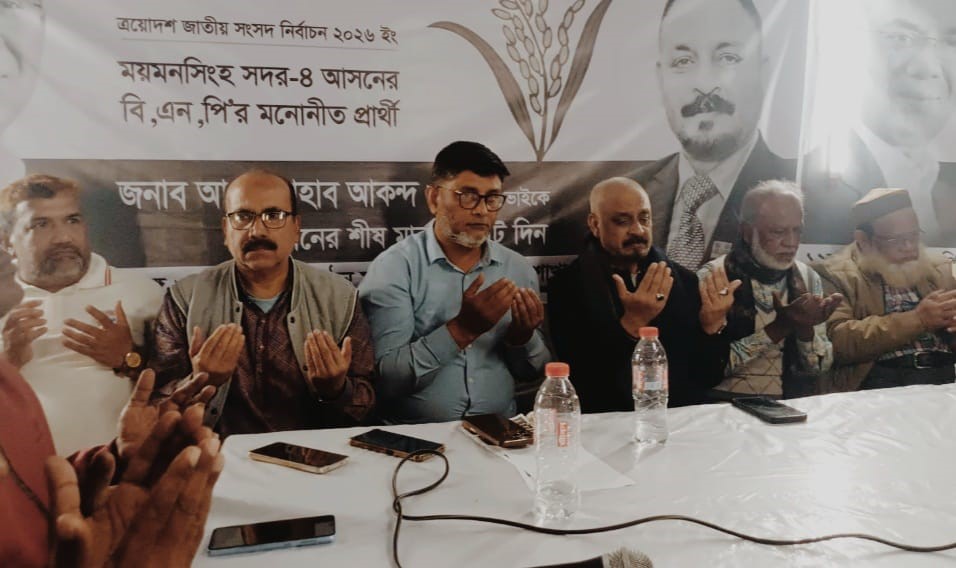

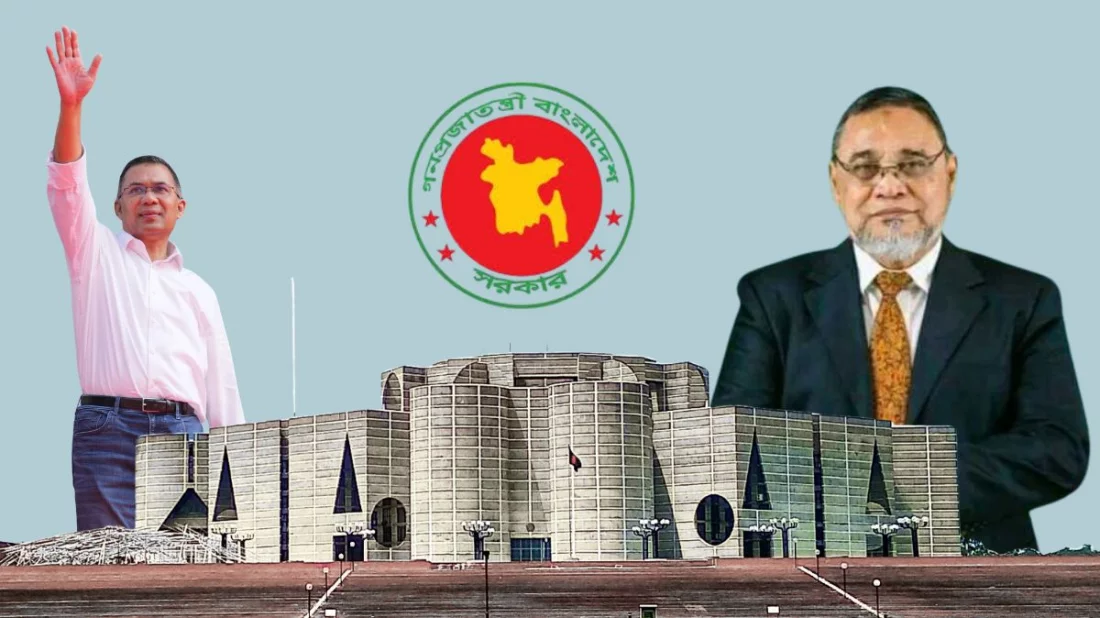

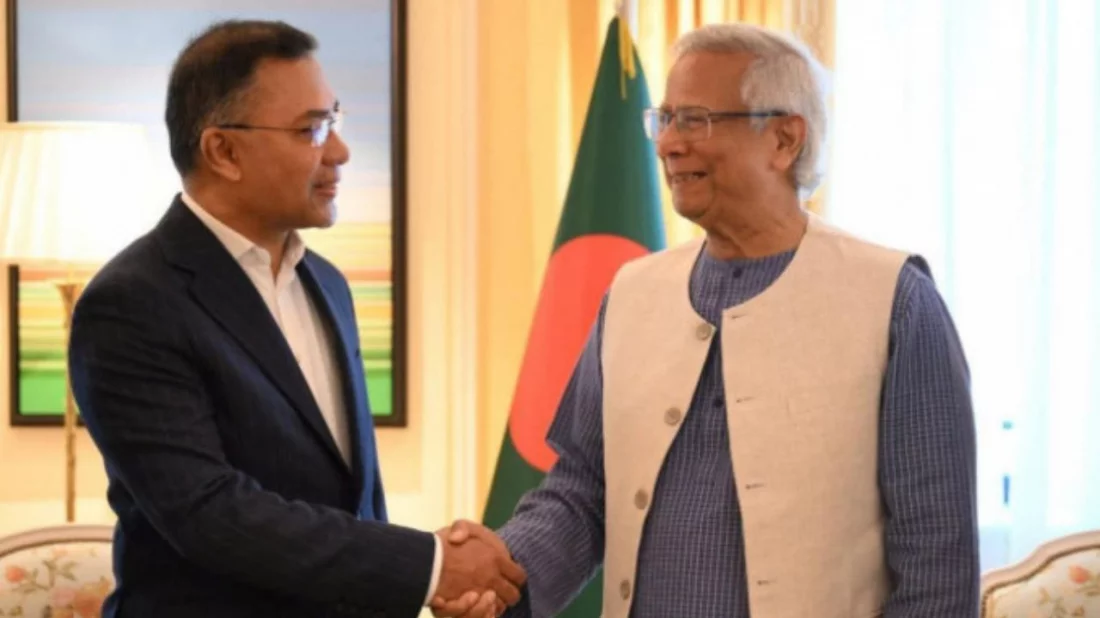

Reporter Name

Reporter Name